Table Of Content

Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years. You can think about refinancing (if you already have a loan) or shop around for other loan offers to make sure you’re getting the lowest interest rate possible. Our partners cannot pay us to guarantee favorable reviews of their products or services. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Monthly Pay: $2,727.35

The table below is updated daily with current mortgage rates for the most common types of home loans. Next, enter the homeowners insurance premium you'll need to pay each month. Your insurance provider may also offer a calculator on their website. Most financial institutions offer several payment frequency options besides making one payment per month. Switching to a more frequent mode of payment, such as biweekly payments, has the effect of a borrower making an extra annual payment. Estimate the cost of your monthly home loan payment, including taxes and insurance.

Start your home buying research with a mortgage calculator

That’s because most lenders’ minimum mortgage requirements don’t usually allow you to take on a mortgage payment that would amount to more than 28% of your monthly income. Our mortgage calculator can help you estimate your monthly mortgage payment. This calculator estimates how much you’ll pay for principal and interest.

Rocket Mortgage

If you take out a conventional mortgage and put down less than 20%, you’ll likely have to pay for PMI. However, you can generally ask your lender to cancel your PMI once your mortgage balance reaches 80% of your home’s value. Using a mortgage calculator will give you a rough estimate of what you can expect to pay for homes in different locations at different price points. However, your exact rates may vary when you apply for a mortgage loan. Use the mortgage calculator to see what your payments will be like with both options.

Typical Mortgage Fees and Costs

If this is your first time shopping for a mortgage, the terminology can be intimidating. It also can be difficult to understand what you’re paying for—and why. Although there is no set time frame, the custom within the real estate industry is that mortgage pre-approval is valid for between 90 to 180 days. Make sure to ask your lender how long your pre-approval lasts, or look for this expiration date on your pre-approval letter. Under "Down payment," enter the dollar amount of your down payment (if you’re buying) or the amount of equity you have (if refinancing).

Choose the Right Mortgage Type

If you don’t have enough saved for a 20% down payment, you’re going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments. When you’re looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they don’t cover property taxes or homeowners insurance in most cases. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan.

FHA loan (government loan)

Simply enter your email to get monthly content that’ll help you navigate the market with confidence. Want to get rid of your house payment for good by paying off your home loan? An amount paid to the lender, typically at closing, in order to lower the interest rate. Also known as “mortgage points” or “discount points.” One point equals 1% of the loan amount (for example, 2 points on a $100,000 mortgage would equal $2,000). A prequalification estimates how much house you can afford, while a preapproval verifies your financial information for a loan.

Learn More About Buying a House

For example, if you’re planning to retire early, determine how much money you need to save or invest each month and then calculate how much you’ll have leftover to dedicate to a mortgage payment. A $2,000 per month mortgage payment is too much for borrowers earning under $92,400 a year, according to typical financial advice. A conservative or comfortable DTI ratio is usually considered to be anywhere from 1% to 26%, if you only include mortgage debt. A $2,000 per month mortgage payment represents a 26% DTI if you earn $92,400 per year. A mortgage payment calculator helps you determine how much you will need to pay each month to pay off your mortgage loan by a specific date. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income.

How Much Is A Down Payment On A House? - Bankrate.com

How Much Is A Down Payment On A House?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

The monthly mortgage payment on a $300,000 house would likely be around $1,980 at current market rates. That estimate assumes a 6.9% interest rate and at least a 20% down payment, but your monthly payment will vary depending on your exact interest rate and down payment amount. Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or we’ll estimate the costs based on the state the home is located in. Then, click “Calculate” to see what your monthly payment will look like based on the numbers you provided.

These autofill elements make the home loan calculator easy to use and can be updated at any point. Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees. Chase serves millions of people with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place.

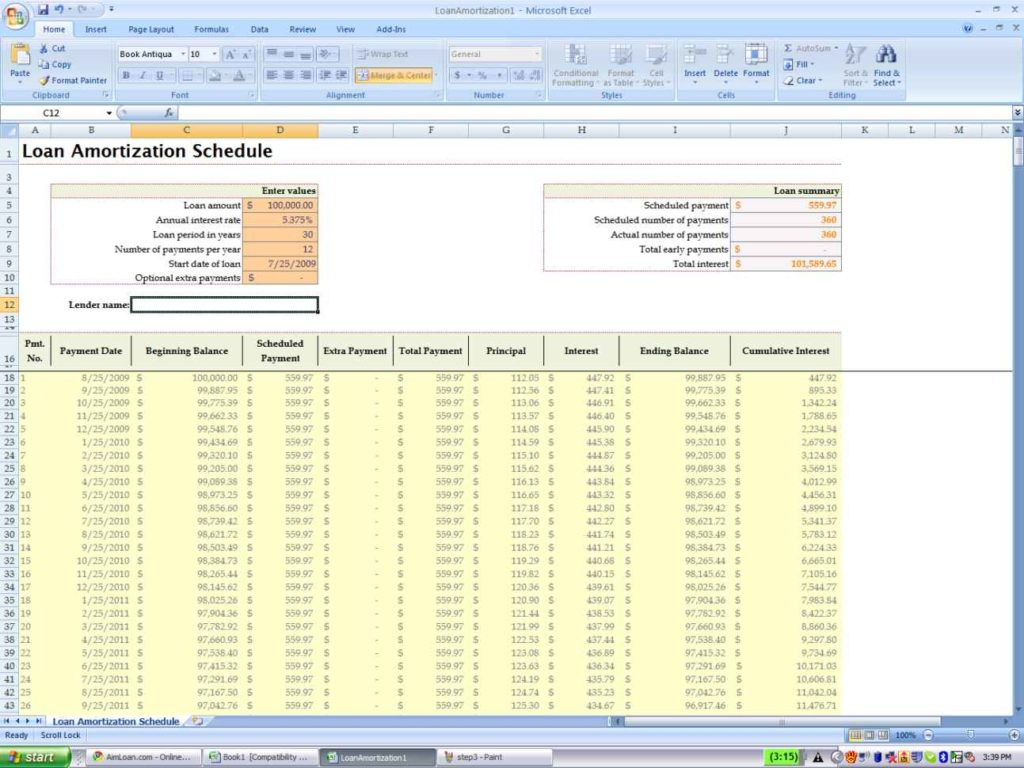

The amortization table below illustrates this process, calculating the fixed monthly payback amount and providing an annual or monthly amortization schedule of the loan. For example, a bank would amortize a five-year, $20,000 loan at a 5% interest rate into payments of $377.42 per month for five years. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford.

Many forecasts expect rates to fall this year now that inflation has been coming down. But recently, data has been somewhat sticky, so we may need to wait a bit longer for rates to go down. This is a significant slowdown compared when it peaked at 9.1% in 2022, but a slight uptick from the previous month's reading. We'll likely need to see more slowing before rates can drop substantially. By clicking on "More details," you'll also see how much you'll pay over the entire length of your mortgage, including how much goes toward the principal vs. interest. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches.

No comments:

Post a Comment